Ebay International AG, Mumbai v. Assessee

Income Tax Appellate Tribunal, Mumbai | ITA No. 6784/M/2010 | Jurisdiction: India

SECONDARY_KEYWORDS: Article 7 DTAA; FTS; Marketing Support; Swiss Resident; Online Marketplace

CASE_TITLE: Ebay International AG, Mumbai v. Assessee • PUBLISH_DATE: 2025-11-01 • AUTHOR_NAME: Gulzar Hashmi • LOCATION: India

Quick Summary

A Swiss company ran Indian-facing websites (ebay.in and b2motors.ebay.in). Its Indian group entities—eBay India and eBay Motors—gave only marketing and support. The Assessing Officer treated the Indian receipts as “fees for technical services.” The CIT(A) disagreed. The Income Tax Appellate Tribunal (ITAT) Mumbai held there was no permanent establishment (PE) in India because the Indian entities did not negotiate or conclude contracts for the Swiss company and did not manage its business. With no PE under Article 5 of the DTAA, business profits were not taxable in India under Article 7.

Issues

- Do eBay India and eBay Motors amount to a dependent agent PE of the Swiss assessee?

- Do they qualify as dependent agents with authority habitually exercised to negotiate or conclude contracts?

Rules

- Article 5 (Dependent Agent PE): A PE arises if a person in India has, and habitually exercises, authority to negotiate and conclude contracts for the foreign enterprise.

- Article 7 (Business Profits): Business profits are taxable in India only if the foreign enterprise has a PE in India to which the profits are attributable.

Facts (Timeline)

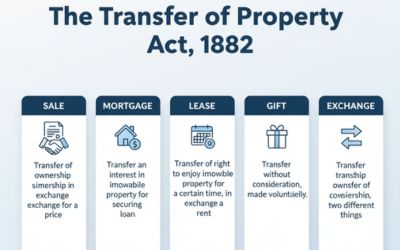

Optional Illustration

Swiss Incorporation: The assessee is a Swiss tax resident. It operates ebay.in and b2motors.ebay.in for Indian users as online marketplaces.

Support Agreements: eBay India and eBay Motors (group entities in India) provide marketing and support services under agreements.

Revenue from India: The websites earn ₹12,00,39,045 during the relevant year.

Assessee’s Stand: Profits are taxable in India only if there is a PE under Article 5. Since no PE exists, no tax arises on these receipts in India.

AO’s View: Treats amounts as Fees for Technical Services (FTS).

CIT(A): Reverses AO; characterizes services as marketing support, not FTS.

Appeal: Matter goes to ITAT Mumbai.

Arguments

Appellant (Assessee)

- Indian entities only gave marketing/support; they had no authority to make or conclude contracts.

- No place of management in India.

- Therefore, no PE under Article 5; Article 7 cannot tax business profits in India.

Revenue

- Indian operations and collections show a real presence in India.

- Services were technical and taxable as FTS, or the Indian entities acted as dependent agents.

Judgment (ITAT Mumbai)

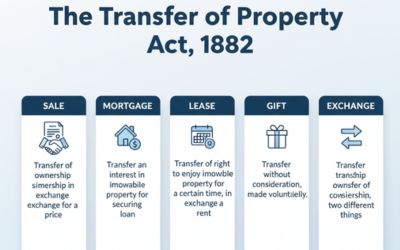

Optional Illustration

- eBay India and eBay Motors were not dependent agent PEs; they did not perform functions listed in Article 5(5) clauses (i)–(iii).

- Providing marketing services or collecting payments and forwarding them to the Swiss company does not amount to entering into contracts on behalf of the assessee.

- They did not create a place of management under Article 5(2)(a) since they only offered market support.

- Because there was no PE, Article 7 did not permit taxation of the assessee’s business profits in India.

Ratio Decidendi

A dependent agent PE requires authority that is actually used to negotiate or conclude contracts for the foreign enterprise. Pure marketing and support—without such authority—does not create a PE. Collections routed to the foreign principal, by themselves, do not change this result.

Why It Matters

- Clarifies PE risk for digital platforms using Indian support entities.

- Separates support functions from contract authority in dependent agent analysis.

- Guides treaty interpretation under Articles 5 and 7 for cross-border e-commerce models.

Key Takeaways

- No authority, no PE: Habitual contract authority (and its exercise) is the core test.

- Support ≠ management: Market support does not create a place of management.

- Collections alone are neutral: Payment flows do not prove contract conclusion power.

- Article 7 shield: Without a PE, India cannot tax business profits under the DTAA.

Mnemonic + 3-Step Hook

Mnemonic: “MAC Test” — Marketing ≠ PE, Authority must exist and be used, Contracts are key.

- Ask: Did the Indian entity negotiate/conclude contracts?

- Check: Is that authority habitually exercised?

- Decide: If no to either, no dependent agent PE.

IRAC Outline

Issue: Whether eBay India/eBay Motors created a dependent agent PE for the Swiss assessee.

Rule: Article 5—agent with and habitually exercising authority to negotiate/enter contracts; Article 7—profits taxable only if PE exists.

Application: Indian entities only did marketing and support; they did not negotiate or conclude contracts; no place of management.

Conclusion: No PE; business profits not taxable in India under Article 7.

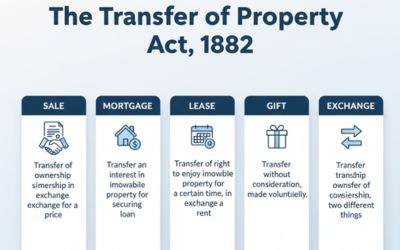

Glossary

- Permanent Establishment (PE)

- A fixed place or qualifying agent through which a foreign business is taxed in the source country under a treaty.

- Dependent Agent

- An agent mainly working for the foreign enterprise, with and exercising contract authority.

- Article 5 (DTAA)

- Defines when a PE exists, including through a dependent agent.

- Article 7 (DTAA)

- Taxation of business profits—requires a PE in the source state.

- FTS

- Fees for Technical Services; a separate tax concept from business profits.

FAQs

Share

Related Post

Tags

Archive

Popular & Recent Post

Comment

Nothing for now