Girjesh Dutt v. Data Din (AIR 1934 Oudh 35)

High Court of Oudh 1934 AIR 1934 Oudh 35 7 min read India

By Gulzar Hashmi • Published on

Quick Summary

This case clarifies Section 13 of the Transfer of Property Act, 1882. When property is transferred for the benefit of an unborn person, that person must get full ownership on birth. A “life interest” for the unborn is not allowed. Any later gift that relies on such an invalid clause also fails.

girjesh-dutt-v-data-din-1934-oudhIssues

- Is a transfer valid if it gives a life interest to an unborn person?

- Do later clauses that depend on such an invalid transfer still operate?

- Did the deed breach Section 13 by not giving absolute ownership to the unborn beneficiary?

Rules

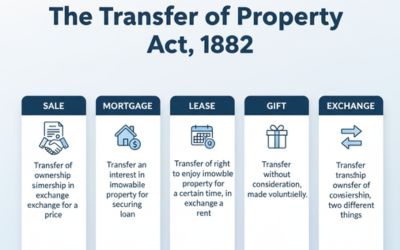

- Section 13 TPA: A transfer for an unborn person must create absolute ownership.

- A life interest or any limited estate cannot be conferred on an unborn person.

- Any further transfer that depends on the invalid life interest also becomes void.

Facts (Timeline)

Arguments

Appellant (X)

- The deed intended a full plan; if daughters did not take absolutely, the gift over to X should operate.

- Later event—B died childless—so X should take.

Respondent

- Section 13 bars any life interest for unborn persons.

- Since the daughters’ interest was void, the gift over, which depended on it, must also fail.

Judgment

The High Court held the life interest to unborn daughters void under Section 13. As the gift over to X depended on that void interest, it also fell. The court stressed that validity is judged by the deed’s words at the time of transfer, not by later events like B dying childless. Appeal dismissed.

Ratio Decidendi

An unborn person can only be given property with absolute ownership when they come into existence. Any attempt to create a limited estate (life interest) for an unborn person breaches Section 13 and is void. A subsequent clause relying on that invalid gift cannot stand.

Why It Matters

- Drafting clarity: For unborn beneficiaries, draft a single absolute transfer.

- Avoid cascades: Gifts depending on void clauses risk collapsing.

- Exam hack: “Unborn = Absolute or Invalid.”

Key Takeaways

- Section 13 demands absolute interest for the unborn.

- Life interest to unborn = void.

- Dependent gift over = void if based on the invalid clause.

- Validity is assessed from the deed’s language, not later events.

Mnemonic + 3-Step Hook

Mnemonic: “Unborn = All or Fall.”

- Ask: Is the beneficiary unborn at transfer?

- Check: Do they get absolute ownership?

- Conclude: If not absolute, the clause—and any gift over—falls.

IRAC Outline

Issue

Can a deed give a life interest to an unborn person? If void, do dependent gifts survive?

Rule

Section 13 TPA: Unborn must take absolutely; limited interests are void; dependent gifts fail.

Application

The deed created a life estate for unborn daughters → violates Section 13 → void. Gift to X hinged on that clause → also void.

Conclusion

Both the unborn daughters’ life interest and the gift over to X were invalid. Appeal dismissed.

Glossary

- Unborn Person

- Someone not in existence at the time of transfer.

- Absolute Interest

- Full ownership without limits or conditions.

- Life Interest

- Right to use property only during one’s lifetime; not full ownership.

- Gift Over

- A later gift that takes effect if an earlier one fails or ends.

FAQs

Share

Related Post

Tags

Archive

Popular & Recent Post

Comment

Nothing for now