The Anglo-French Textile Co. Ltd. v. CIT

Quick Summary

This case explains when a foreign company is taxed in India because of a business connection. The company had a mill in French India (Pondicherry) but bought cotton through agents in British India. The Court held: there is a business connection, but tax covers only the slice of profit that fairly belongs to the Indian operations.

Court: Madras High Court

Holding: Apportion profits; tax only Indian-attributable part

Issues

- Did the company have a business connection in British India under Section 42(1)?

- If yes, should profits be apportioned so that only the part linked to Indian operations is taxed?

Rules

- If only some profit-making steps happen in British India, tax is limited to the reasonable share of profits from those steps.

- Section 42(1) covers income from a business connection in India; Section 42(3) guides apportionment.

Facts (Timeline)

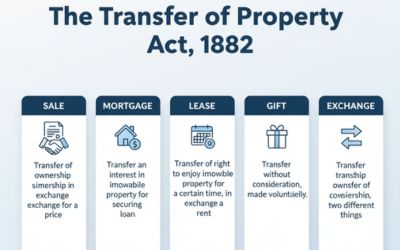

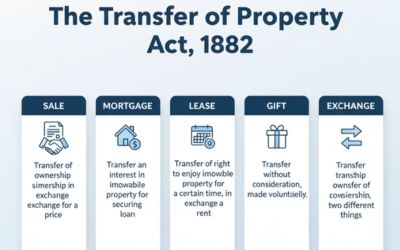

View ImageCompany & Location: Anglo-French Textile Co. Ltd., incorporated in the U.K., ran a spinning and weaving mill at Pondicherry (then French India). It made yarn and cloth there.

Indian Purchases: All cotton purchases were done in British India by Best & Co. Ltd., Madras, acting as the company’s agents for India with wide powers. Agents earned a monthly salary and profit-linked commission.

Pre-1939 Assessments: Profits from sales in British India were assessed to income tax.

1939–40: Company said it had discontinued business in British India from 1 April 1939 and got relief under Section 25(3).

Re-assessment: The Income-tax Officer held there was still a business connection in British India and assessed a portion of profits under Sections 42(1) & 42(3). The AAC and Tribunal upheld it. The matter reached the High Court.

Arguments

Appellant (Company)

- Core manufacturing and sales decisions were outside British India; cotton buying alone should not trigger full tax.

- If any link exists, only a fair share of profits (attributable to Indian buying) can be taxed.

Respondent (Revenue)

- Agents in Madras had wide authority; this created a real and continuous business connection.

- Profits flowed from connected operations; tax could be levied on income linked to India.

Judgment

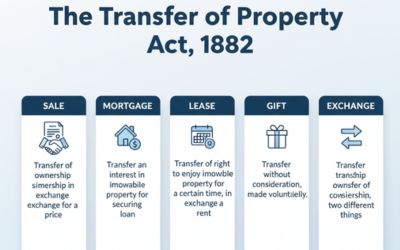

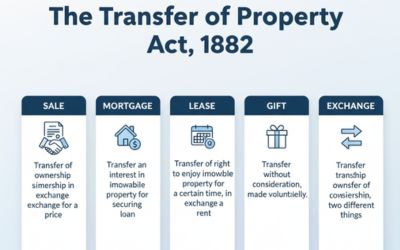

View ImageThe High Court allowed the appeal. It said the company’s income could not be treated as wholly arising in India. There must be a proper allocation between income from Indian operations and income from operations outside India. Only the Indian-attributable part is taxable here.

Ratio (Legal Principle)

Where only part of the operations leading to profits is carried on in British India, the law directs apportionment. Indian tax applies only to the portion of profits reasonably attributable to operations performed in India.

Why It Matters

- Clarifies how cross-border businesses face Indian tax when some steps occur in India.

- Builds the idea that nexus is about real links, not mere presence.

- Protects against over-taxation by insisting on fair profit attribution.

Key Takeaways

- Business connection can arise through empowered agents operating in India.

- Tax follows the value created in India, not the entire global profit.

- Apportionment is a legal requirement when operations are split across borders.

- Relief or discontinuance in one year does not erase historic nexus if activities continue.

Mnemonic + 3-Step Hook

Mnemonic: “BUY-MAKE-TAX-SLICE”

- BUY in India by agents → shows connection.

- MAKE outside India → not all profit is Indian.

- TAX only where nexus exists.

- SLICE profits fairly by apportionment.

3-Step Hook

- Find the Indian link (agents/operations).

- Measure the value done in India.

- Apportion and tax only that slice.

IRAC Outline

| Issue | Rule | Application | Conclusion |

|---|---|---|---|

| Is there a business connection in British India? If yes, how much profit is taxable? | Section 42(1) + 42(3): tax income from business connection; apportion where only part of operations are in India. | Agents in Madras purchased cotton with broad powers. This created the link. But manufacturing and much selling were outside India. | Yes, business connection exists. Tax only the apportioned profits tied to Indian operations. |

Glossary

- Business Connection: A real link between foreign profits and activities carried out in India.

- Apportionment: Splitting total profits to match where the value was created.

- Agency: When one party acts with authority for another.

FAQs

Related Cases

Publication & SEO Block

- CASE_TITLE: The Anglo-French Textile Co. Ltd. v. CIT

- PRIMARY_KEYWORDS: business connection; Section 42(1); profit apportionment

- SECONDARY_KEYWORDS: agency in India; Best & Co.; Pondicherry; British India; income attribution

- PUBLISH_DATE: 01 Nov 2025

- AUTHOR_NAME: Gulzar Hashmi

- LOCATION: India

- Slug:

the-anglo-french-textile-co-ltd-v-cit

Share

Related Post

Tags

Archive

Popular & Recent Post

Comment

Nothing for now