Principles of Natural Justice and Constitution of India

Instances of the Principle of Natural Justice in the Indian Constitution

Article 14 of the Indian Constitution guarantees equality before the law and equal protection of the law for all citizens. It prohibits any form of discrimination and forbids both discriminatory laws and administrative actions. The article establishes that all individuals must be treated equally and without discrimination.

Case Study: Delhi Transport Corporation v. DTC Mazdoor Union

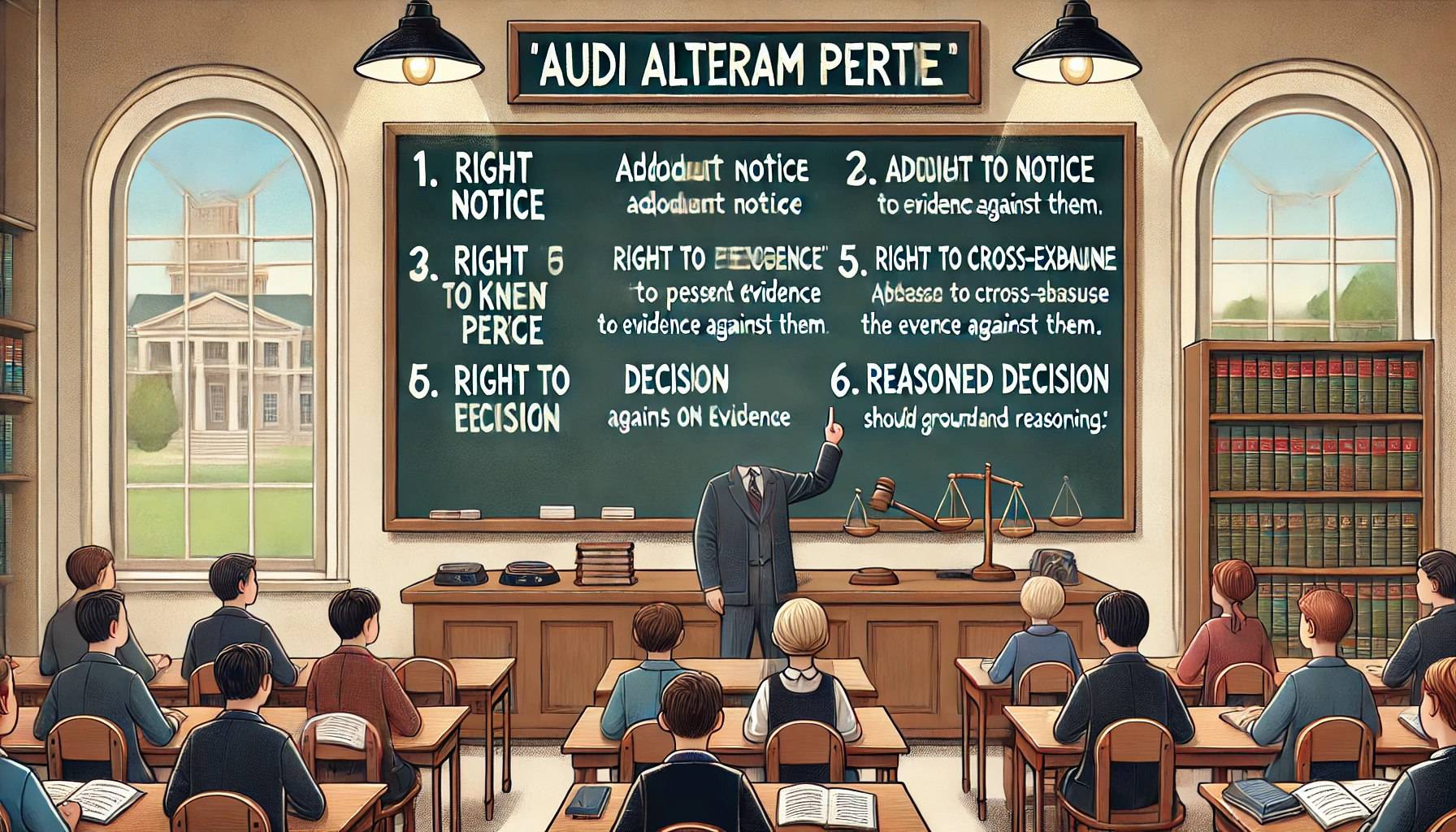

The Supreme Court ruled that the principle of "audi alteram partem" (the right to be heard) enforces the equality clause in Article 14. This principle applies not only to quasi-judicial bodies but also to administrative orders that adversely affect a party, unless explicitly excluded by the relevant law.

The court in Maneka Gandhi vs Union of India clarified that Article 14 includes elements of the natural justice principle, reinforcing the concept of equality as guaranteed by the Constitution.

Similarly, in Cantonment Board, Dinapore vs Taramani Devi, the court upheld that the rule of "audi alteram partem" is an integral part of Article 14.

Article 21 of the Constitution of India

Article 21 of the Indian Constitution guarantees the right to life, and the term "procedure established by law" can be interpreted to include the principles of natural justice.

Justice Bhagawati once stated, "The principle of reasonableness, which is legally and philosophically an essential element of equality or non-arbitrariness, pervades Article 14 like a brooding omnipresence."

Thus, actions under Article 21 must be conducted in a fair, just, and reasonable manner, without any arbitrary or oppressive actions.

Application of Natural Justice Principles in Income-Tax Proceedings

It is well established that income-tax authorities, when acting in their quasi-judicial capacity, must adhere to the principles of natural justice. In Suraj Mall Mohta and Co. v. A. V. Visvanatha Sastri, the Supreme Court held that assessment proceedings before an Income-tax officer are judicial in nature and must observe all judicial proceedings' formalities. This includes the right of the assessee to inspect records and relevant documents before presenting evidence in rebuttal, a right not removed by any provision of the Income Tax Act.

Case Study: Dhakeshwari Cotton Mills Ltd. v. CIT

The Supreme Court emphasized that the principles of natural justice apply to proceedings under the Income-tax Act. The Court noted that it was inappropriate for the Tribunal to consider the department's statement of gross profit rates from other cotton mills without showing the statement to the assessee or giving them an opportunity to contest its relevance.

Similarly, in Gargi Din Jwala Prasad v. CIT, the Court held that the power of revision under Section 25 of the Wealth Tax Act, 1962, is quasi-judicial, not administrative. The Commissioner must exercise this power impartially and in accordance with natural justice principles. The Commissioner must consider the objections of the affected party impartially and decide the issue without bias, not based on undisclosed matters or under the influence of another authority. This was also affirmed by the Supreme Court in Sirpur Paper Mill.

Share

Related Post

Tags

Archive

Popular & Recent Post

Comment

Nothing for now